Introducing Symphony.VI Portfolio

Consistently Top-Rated Trading System (Futures Truth)

Symphony.VI is a diversified futures trading strategy that should be consideredthe backbone of your automated trading plans. Simple and easy to deploy, trades futures, E-Minis, and E-Micros, and provides consisten opportunities for growth and ROI.

Powered by an advanced time-based quantitative model combined with technical analysis, Symphony.VI has been ranked by Future Truth as one of the best trading systems for many years in a row.

You owe it to yourself to see how Symphony can be deployed to help you grow youar wealth in a hands-free, automated environment.

Symphony.VI is a suite of specialized trading algos deployed across set classes of assets/symbols providing a diversified & leveraged solution for clients. The results speak for themselves. End-user licenses available for @MultiCharts, @NinjaTrader, and @TradeStation, or through managed accounts at @Striker or @Fox Group.

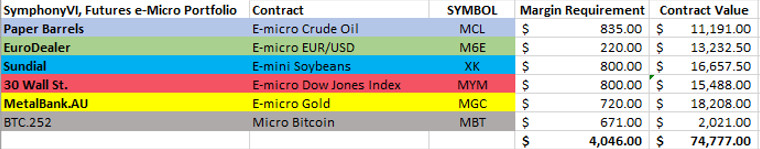

*Agriculture – i-Wheat, e-Mini Wheat

*Currency – EuroDealer, e-Micro Euro/USD

*Energy – Paper Barrels, e-Micro Crude Oil

*Financial – 30 Wall St., Micro e-Mini Dow Jones Index

*Precious Metal – Golden1, e-Micro Gold

*Cryptocurrency – BTC.252, Micro Bitcoin

|

Select how you want to trade with Symphony.VI.

|

*SELF DIRECTED Symphony.VI

- Secure your system(s), execute end-user license, e-mail copy.

- Open a futures trading account.

- if you don't already have one download either MultiCharts 14, NinjaTrader 8 or TradeStation 10 platform on your computer (or, if you prefer, we can help set you up with a secure remote server by one of our agents). Our team installs the strategy on your trading platform or your remote server.

- Monitor your account as the strategy automatically executes trades.

*BROKER ASSISTED Symphony.VI

- Secure your system(s), execute end-user license, e-mail copy.

- Open an account at any of our preferred brokerages- Interactive Brokers, TD Ameritrade, TradeStation Securities or Striker Securities.

- Fund your trading account.

- Sit back and monitor trading activity. Your account, managed by the broker, will trade our automated strategies.

|

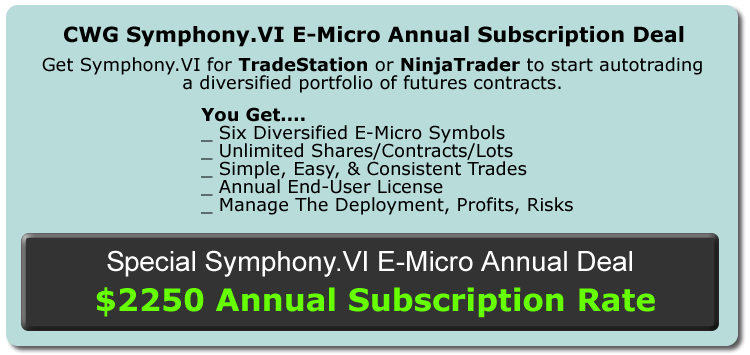

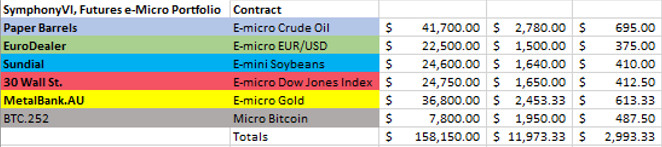

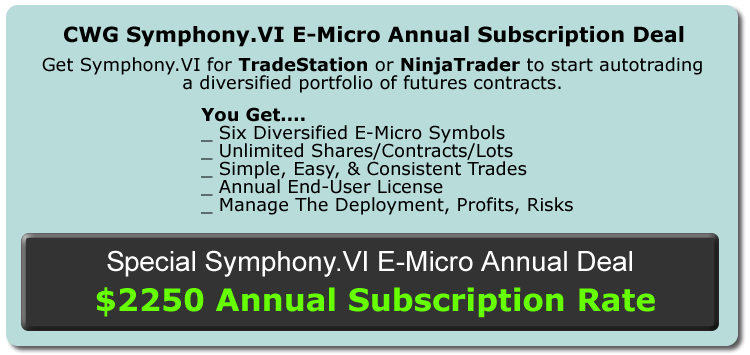

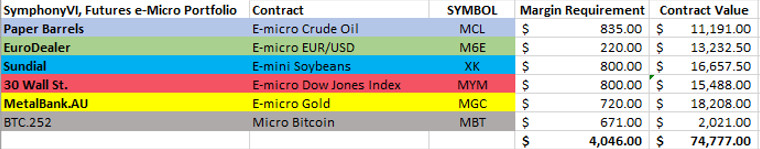

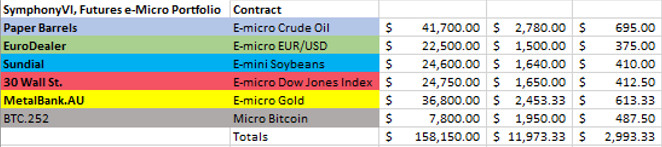

Symphony.VI E-Micro Portfolio D

|

Diversified Portfolio

Backtested Portfolio Results

|

Minimum Account Size Required: $4,500.00

Average # Of Trades Annually: 20~35+

Average Annual Return *: $11,973.33

Average Quarterly Return *: $2,993.33

Average Monthly Return *: $997.78

Quarterly Subscription Cost: $1,000.00

* Average Annual, Quarterly, & Monthly Returns are based on Backtest results 2000~2020. Actual results will vary depending on market conditions/trends. Backtested results are not accurate representations of forward expectations. Trading involves risks or financial loss. Do not trade unless you are willing to accept these risks and understand futures contracts are leveraged trading instruments. See the FULL DISCLAIMER at the bottom of this page.

|

|

|

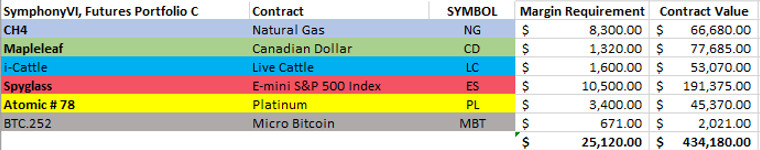

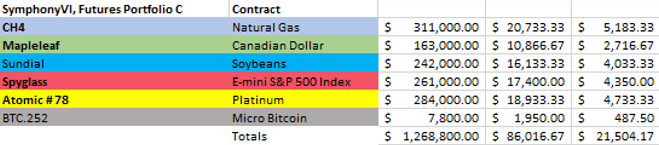

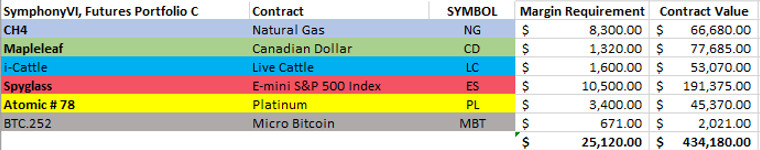

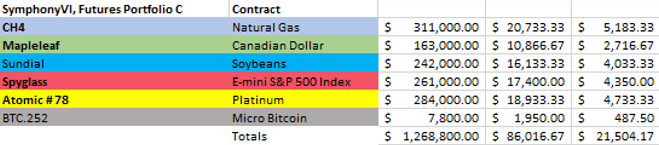

Symphony.VI Portfolio C

|

Diversified Portfolio

Backtested Portfolio Results

|

Minimum Account Size Required: $30,000.00

Average # Of Trades Annually: 20~35+

Average Annual Return *: $86,016.67

Average Quarterly Return *: $21,504.17

Average Monthly Return *: $7,168.06

Quarterly Subscription Cost: $3,000.00

* Average Annual, Quarterly, & Monthly Returns are based on Backtest results 2000~2020. Actual results will vary depending on market conditions/trends. Backtested results are not accurate representations of forward expectations. Trading involves risks or financial loss. Do not trade unless you are willing to accept these risks and understand futures contracts are leveraged trading instruments. See the FULL DISCLAIMER at the bottom of this page.

|

|

|

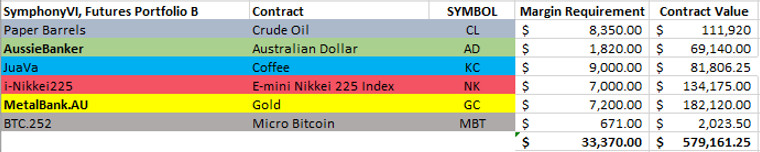

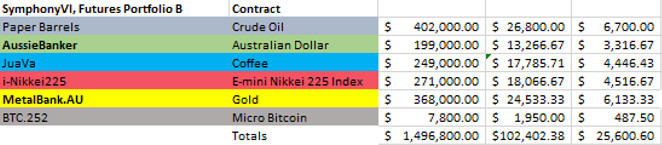

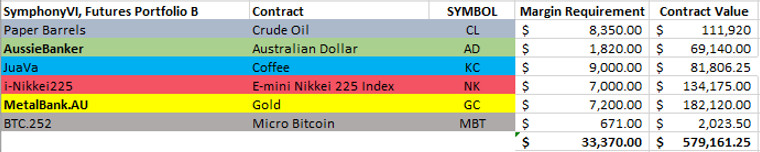

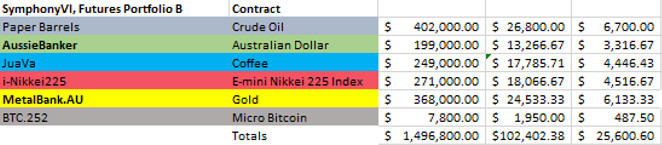

Symphony.VI Portfolio B

|

Diversified Portfolio

Backtested Portfolio Results

|

Minimum Account Size Required: $35,000.00

Average # Of Trades Annually: 20~35+

Average Annual Return *: $102,402.38

Average Quarterly Return *: $25,600.60

Average Monthly Return *: $8,533.53

Quarterly Subscription Cost: $4,000.00

* Average Annual, Quarterly, & Monthly Returns are based on Backtest results 2000~2020. Actual results will vary depending on market conditions/trends. Backtested results are not accurate representations of forward expectations. Trading involves risks or financial loss. Do not trade unless you are willing to accept these risks and understand futures contracts are leveraged trading instruments. See the FULL DISCLAIMER at the bottom of this page.

|

|

|

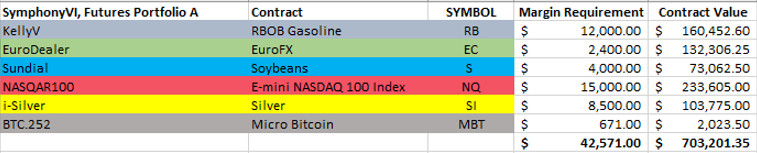

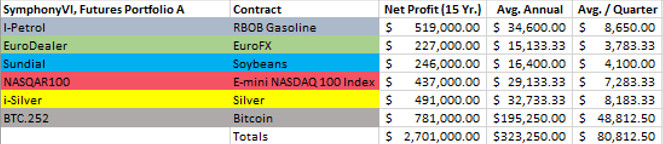

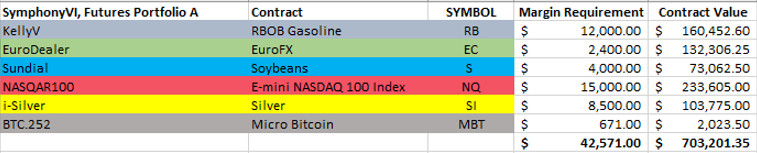

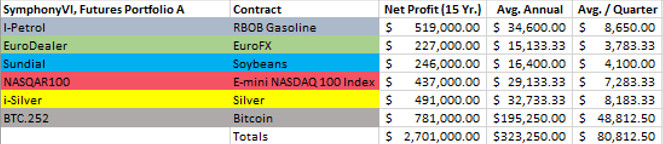

Symphony.VI Portfolio A

|

Diversified Portfolio

Backtested Portfolio Results

|

Minimum Account Size Required: $45,000.00

Average # Of Trades Annually: 20~35+

Average Annual Return *: $323,250.00

Average Quarterly Return *: $80,812.50

Average Monthly Return *: $26,937.50

Quarterly Subscription Cost: $5,000.00

* Average Annual, Quarterly, & Monthly Returns are based on Backtest results 2000~2020. Actual results will vary depending on market conditions/trends. Backtested results are not accurate representations of forward expectations. Trading involves risks or financial loss. Do not trade unless you are willing to accept these risks and understand futures contracts are leveraged trading instruments. See the FULL DISCLAIMER at the bottom of this page.

|

|

|